Insurance Regulatory System - Reporting System for the Auditing Information of the China Insurance Regulatory Commission

Insurance Regulatory System - Reporting System for the Auditing Information of the China Insurance Regulatory Commission

Overview

Insurance audit is an economic activity to check and supervise the compliance, legitimacy, and validity of the business and financial activities of insurance enterprises at all levels based on national financial principles, policies, Insurance Law, and other laws and regulations.

The China Insurance Regulatory Commission designed and developed the on-site insurance auditing system to adapt to the informationalization requirements of insurance regulatory work, which changes the traditional thinking and behavior of on-site inspections for insurance companies, expands the coverage of information searches for on-site inspections, and thus effectively improves the efficiency of the on-site inspection work at insurance companies and reduces personnel cost of the regulatory work. The insurance auditing system of the China Insurance Regulatory Commission was developed for use in 2009, and was upgraded in 2012.

iSoftStone’s reporting system for insurance audit information was designed and developed according to the date format and number fetching caliber specified by the China Insurance Regulatory Commission, to help insurance companies with the data preparation work required for on-site inspections. The system effectively achieves docking with the insurance audit system, in addition to providing data extraction functions for underwriting, claims, reinsurance, payments, finance, documents and other information. It also performs code correspondence as well as data conversion according to the regulations of the China Insurance Regulatory Commission, thereby forming the format data required for audit reporting.

Features

Synchronization with the Regulatory System

iSoftStone has a deep understanding of regulatory dynamics due to its long-term participation in and construction of various regulatory systems, and the system synchronizes with regulators for system maintenance, updated with the latest regulatory risk concepts, thereby providing more rapid and effective service for insurance companies.

Innovative Data Model

iSoftStone has an independent and innovative regulatory data model that can be applied to the entire regulatory business, and this data model has been successfully utilized in many insurance companies. As a result, it completely satisfies the need for automated data extraction for all kinds of regulatory reports.

Efficient Data Processing Technology

iSoftStone has introduced multi-machine parallel technical capability in its data processing, and therefore when the quantity of basic insurance data or reporting increases constantly, the data processing capability of system can be expanded simply by increasing the hardware equipment to guarantee the system’s performance and protect the investment.

Functions

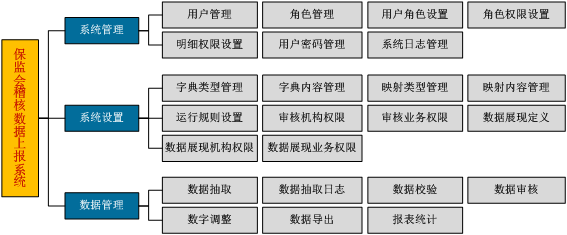

iSoftStone’s reporting system for insurance audit information includes three major functions: system management, system setup and data management.

Insurance

Insurance Solutions

Insurance Regulatory System - Statistics Reporting System of the China Insurance Regulatory Commission

WeChat Insurance Marketing Service Platform

Insurance Regulatory System - Anti-Money Laundering Reporting & Monitoring System

E-commerce System

Insurance Regulatory System - Reporting System for the Auditing Information of the China Insurance Regulatory Commission

Capital Management System

Internet Insurance Core System Based On Cloud Computation