Financial Leasing Solutions

Financial Leasing Solutions

Overview

Financial leasing refers to the type of leasing in which all or most of the risks and rewards related to the ownership of assets are virtually transferred. The ownership of assets can be transferred or not. In 2015, Premier Li Keqiang presided over an executive meeting of the State Council, specifying measures that can accelerate the development of the financial leasing industry, thus better serving the real economy. The meeting pointed out that accelerating the development of financial leasing is an important measure to deepen financial reform, which is conducive to easing the difficulty in and high cost of financing for enterprises, encouraging them to invest more in equipment, and driving industrial upgrading. This measure has effectively driven the development of the financial leasing industry and further accelerated the IT system construction of the industry.

Nowadays, the public is much more familiar with financial leasing than before, believing there is huge market potential. In developed countries, financial leasing business has become "the second largest financing model after bank credit". In China, financial leasing is an important means for the regulators to build a "multi-tier financial market system". Chinese enterprises tend to make huge investment in fixed assets, in this sense, financial leasing has huge development opportunities for finance companies.

At present, the major companies that engage in financial leasing in the market can be divided into four categories: financial leasing companies, finance companies, operation leasing companies and trust companies.

Income Analysis of Financial Leasing Business

1. Supporting the main business

Offering new financing tools to support member units in purchasing new equipment, speeding up technological transformation, improving financial statements, and reducing repayment pressure;

Providing financial leasing services for customers outside the group, to promote the sales of products in the group;

2. Optimizing financial structure

Helping member units to obtain off-balance sheet financing, improve financial structure and indicators, and realize effective financial management;

Striving for a certain degree of preference for them in tax withholding

3. Diversifying financial products

Diversifying the financial product line and providing more financial support for member units;

Helping increase the sales of products in the group;

4. Risk reduction

Making clear the investment areas and the use of funds, to reduce information asymmetry as much as possible;

Attributing the asset rights to a finance company can greatly reduce the business risk involved;

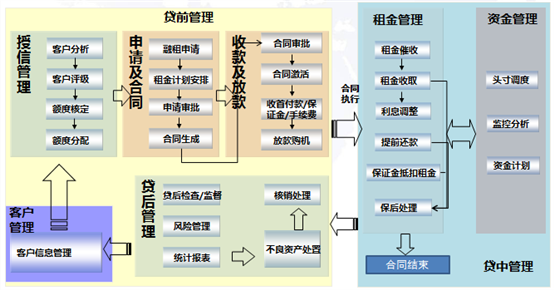

Processes of Financial Leasing Business

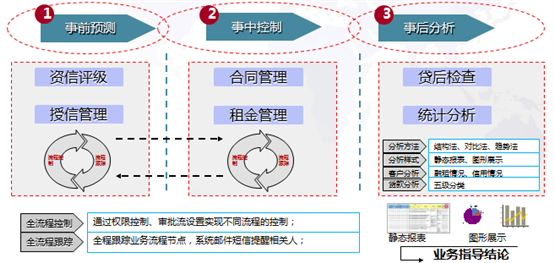

The general processes of financial leasing business include pre-loan management (credit management, contract application, collection making and loan granting), in-loan management (rent management, fund management), post-loan management and customer management.

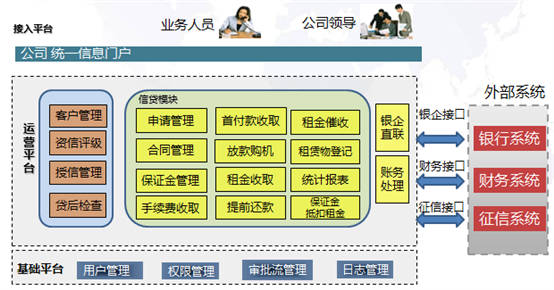

System Architecture of Financial Leasing Solution

The bottom layer of iSoftStone financial leasing solution adopts the industry-leading SOA architecture, and integrates the services and streamlines the processes through the enterprise service bus. At the same time, with the aid of standard interfaces, the business semi-processes can be connected flexibly, and the business system can be truly adapted on demand.

The information system covers the entire business processes

iSoftStone financial leasing solution can provide customers with customized product development services, monitor informatization risks throughout the process covering prior prediction, in-process control, and post analysis, and truly provide information service throughout the life cycle and across the value chain of the business.

Successful Customer Cases

Ø Far Eastern Leasing Co., Ltd.

Ø Sinomach Finance Co., Ltd.

Ø China XD Finance Co., Ltd.