Trust Industry Solutions

Trust Industry Solutions

With the rapid and steady development of China’s financial industry, the trust industry is entering the healthy and rapid development period, and the development of trust companies has successfully reached a new level. Factors in many aspects, such as continuous innovation of trust business, diversification of marketing methods, effective management and control of risks, improvement of customer service levels, particularity and complexity of financial system require trust companies, etc. require trust companies to build efficient and unified IT platforms for management operations and risk control so as to optimize and integrate business processes, realize process-based business processing, improve customer financial service quality, improve asset utilization efficiency and security, realize company-wide business information sharing, provide trust company leaders with comprehensive decision-making information, and enhance core competitiveness of trust companies.

Solution Overview

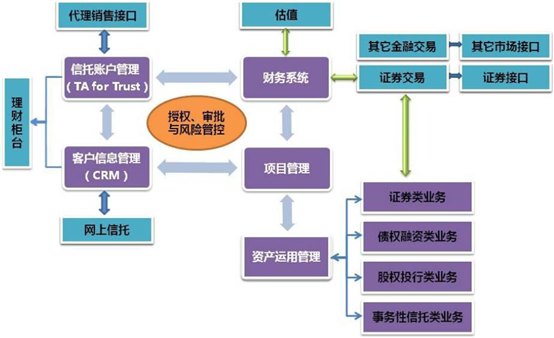

For trust industry solutions, ISoftStone focuses on providing trust companies with all-round information management solutions, such as project management, customer service management, trust account management, asset management, accounting and valuation, risk management, etc., builds the core operating platform for trust companies, and realizes the trust product business chain covering all future business areas of trust companies. Various transactions and peripheral systems can be continuously connected to the core platform with business development and innovation, not only ensuring the stable overall structure and supporting expansion, but also satisfying the needs of adapting to the business development and product innovation of the trust industry in the next few years.

Core Advantages

1. Under the product + service model, ISoftStone provides full-life-cycle and full-value-chain solution services

It can not only provide pure product delivery for trust industry customers, but also provide highly customized product development services according to customer needs, so that it truly provides customers with full-life-cycle and full-value-chain solution services;

2. Overall solutions featured by integration of front, middle and back offices

The overall solutions featured by integration of front, middle and back offices allow the completion of the centralized data management, open up the information flow, and facilitate customers to understand the investment operation in a timely and accurate manner;

3. Industry foresight

The trust industry is featured by rapid development, flexibility and change. iSoftStone’s trust industry solutions can quickly respond to the various needs of trust customers, has industry foresights, and are centered on customer needs and changing as needed.

Solution features

1. iSoftStone solutions realize the customer-centric product management model with the main line of project management and the multiple branches of asset sources and asset utilization, build the enterprise-level business operation platform, and effectively realize the business integration of wealth management and asset management;

2. The integrated solutions featured by integration of front, middle and back offices complete the centralized management of data, and facilitate customers to know the investment operations in a timely and accurate manner;

3. The four main asset management business lines and business customization functions in the categories of securities, debt financing, equity investment banking and transactional trusts fully satisfy the development needs of trust companies for future business innovation;

4. iSoftStone solutions realize the process-based business handling of each department and the information sharing of the whole company, improve business standardization and work efficiency, and reduce the probability of error;

5. iSoftStone provides the comprehensive customer management, customer service and customer analysis platforms, and comprehensively improves wealth management and sales service capabilities as well as wealth management capabilities;

6. iSoftStone provides the financial accounting system fully in compliance with the trust accounting measures, which supports the new accounting standards and the complex accounting processing of financial instruments;

7. iSoftStone solutions realize the management and control of credit risk, market risk, operational risk and legal risk of the entire trust company, and thus effectively reveal and avoid risks;

8. The powerful and flexible custom report tools allow the issuance of business, financial, 1104, EAST and various regulatory statements of trust companies, so that the needs of operation and management at all levels are fully satisfied;

Customer Benefits

1. Improve business level and enhance business processing efficiency;

2. Optimize operating efficiency, keep service-oriented and centralized management, and reduce system maintenance costs;

3. Improve management and control capabilities;

4. Improve customer service quality;

5. Improve resource optimization capabilities, and enhance information collection and processing standardization capabilities;

6. Strengthen risk management and reduce operational risks;

7. Achieve automatic capture and generation of business data, and greatly reduce workload and error rate of manual entry and completion.

Product Architecture

ISoftStone has put forward the information management solutions by making reference to the advanced business management concepts and business models of financial institutions at home and abroad and relying on the experience of many large trust companies in business management projects.

The core application platform of trust companies builds the core foundation consisting of four parts, i.e. customer information management (CRM), trust account management (TA), project asset utilization & management, and financial & business accounting processing; and realizes the asset management business chain with a full coverage of all business fields of trust companies on the four basic modules. Various transactions and peripheral systems, such as the securities trading system, can be continuously connected to the core platform with business development and innovation, so that the stable overall structure is ensured, the expansion is supported, and the future business development and product innovation needs of the trust industry are met.

Introduction to main function modules

1. Customer Information Management System

It manages customer information, responds to customer service requests, provides information disclosure, customer analysis, personalized customer services and other functions; and offers centralized management of customers in three types, i.e. customers with financial needs, partner customers and asset utilization customers.

2. Customer Relationship Management System (CRM)

It integrates daily work management of account managers, customer relationship information management, company activity management, sales process management, performance management and product management, and provides customer analysis, activity analysis, sales process analysis and other functions.

3. Wealth Management Counter System

It provides counter wealth management appointment, subscription, purchase, redemption, liquidation and other functions, offers centralized customer service functions, and supports integrated services of SMS, email, website and call center.

4. Trust Account Management System (TA)

It manages and registers customer trust asset information and share information, provides customer benefit distribution functions, offers management, trading, and transfer functions of customer trust asset account, provides trust product design functions, and supports open trusts, structured trusts, asset-backed securities trusts, annuities and other businesses.

5. Project Management System

It supports the full-cycle information management of various businesses and projects operated by trust companies, provides business OA functions, authorization management, approval management, business acceptance and investigation, business accounting statements and other functions, and supports the business development of trust companies by combining with the business operation management system.

6. Asset Management System

The asset management system consists of different business support modules, including securities trust business module, creditor’s right financing trust business module, equity investment bank trust business module, transactional trust business module, etc., provides project file management functions and risk management functions as well as ledger management of various asset applications. In addition, it supports third-party software system access and expansion.

7. Financial Management System

It has the functions such as financial accounting of trust properties, financial accounting of inherent properties, business and financial statements, etc. It is designed specifically for multiple accounts in the trust industry, and can flexibly handle the cross-account operations for various businesses and the cross-account operations of various query and statistical functions.

8. Risk Management and Control System

The strict approval flow and authority management runs through the entire system. Users can establish data models for early warning of operational risks according to actual needs, define risk indicators, early warning level indicators, index data extraction methods and other information, and finally form the complete and effective early warning of risks and compliance control.

9. Trust Anti-money Laundering System

It conducts full-process management of declaration works of suspicious transactions (behaviors), and provides strong information technology supports for declaration works of suspicious transactions (behaviors) of financial industry customers.

10. Statement Query System

ISoftStone Statement Query System is a set of mature statement tools, including number formula definition, statement template definition, statistical query definition, etc. It has completely Excel-like operation mode, supports user customization, and satisfies customers’ flexible needs for customization of various business and financial statements to the greatest extent.

11. Supporting Products of Regulation

By automatically extracting the existing information in the business systems and combining with manual supplementary recording, it completes the submission of various supervision statements.

(1) PBOC Financial Management and Fund Reporting System

(2) EAST System

(3) 1104 Statement

12. Third-party Interfaces

They include bank agency sales interface, transaction ¥ valuation system interface and other system interfaces.

Successful Customer Cases

CITIC Trust

FOTIC

BRTC

Yingda Trust

Dongguan Trust

Fund trust

Guoyuan Trust