The solution to industrial chain financial service platforms

The solution to industrial chain financial service platforms

Overview

Industrial chain finance refers to a financial service model whereby financial institutions design personalized and standard financial service products for each link of an industrial chain focusing on key enterprises along the industrial chain and provide comprehensive solutions for all enterprises across the industrial chain.

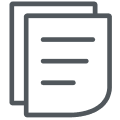

Revolving around key enterprises, financial institutions integrate suppliers, manufacturers, agents, distributors, retailers, and end users into a whole functional network chain structure through the control of information flow, logistics, and capital flow. Its business scope covers a variety of financing models for upstream and downstream enterprises.

Given the policy support of China Banking Regulatory Commission (CBRC), People's Bank of China (PBOC) and the financing difficulties of small and medium-sized enterprises (SMEs), finance companies face many opportunities for developing industrial chain finance. Finance companies' effort to pilot more industrial chain financial services can both meet the financing needs of upstream and downstream enterprises, and facilitate the development of the group's core business.

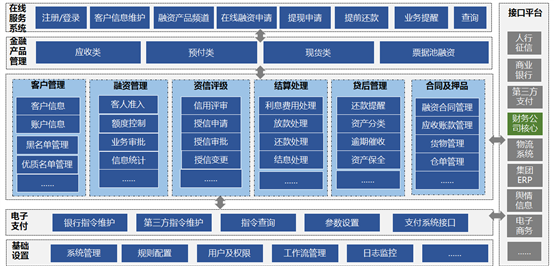

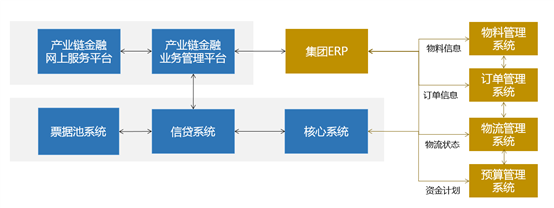

iSoftStone developed an innovative industrial chain financial service platform that can design personalized or standard industrial chain financial products based on a finance company's own business and management needs. This platform can help enable online management of all business processes, and meet a finance company's needs of risk prevention and management analysis for its industrial chain business.

Based on the business development model and management demands for the industrial chain of multiple finance companies, the industrial chain financial service platform utilizes the Internet and IT technology to build the financial service platform, to connect various participants including the upstream and downstream players of the supply chain, logistics service providers, key enterprises, finance companies, and banks, and to integrate the business flow, logistics, capital flow and information flow for information interaction and business coordinated management.

Externally, the company provides online finance, settlement and other financial services for industrial chain customers; internally, the company customizes financial products according to the management needs of a finance company and its group, collect customer information, establish the white list management mechanism for customers, create the customer credit model, and specify the business management processes and risk control model. The aim is to ensure the smooth development of industrial chain financial business and meet the needs of risk control and big data analysis.

Platform Value

Supporting the flexible self-define customer credit rating system that can help to establish a sound customer management system;

Providing a strict risk control management system to reduce financing risks and ensure the safety of capital flow;

Supporting industrial configurations that can meet a variety of financing models and financing needs, as well as various methods for interest bearing and billing;

Configurable business processes can flexibly meet the needs of business management while improving work efficiency;

The ability to manage business flow, logistics, capital flow, and information flow across the system helps ensure the accuracy, continuity and timeliness of the information needed to carry out the industrial chain financial business.